Michael Crayne

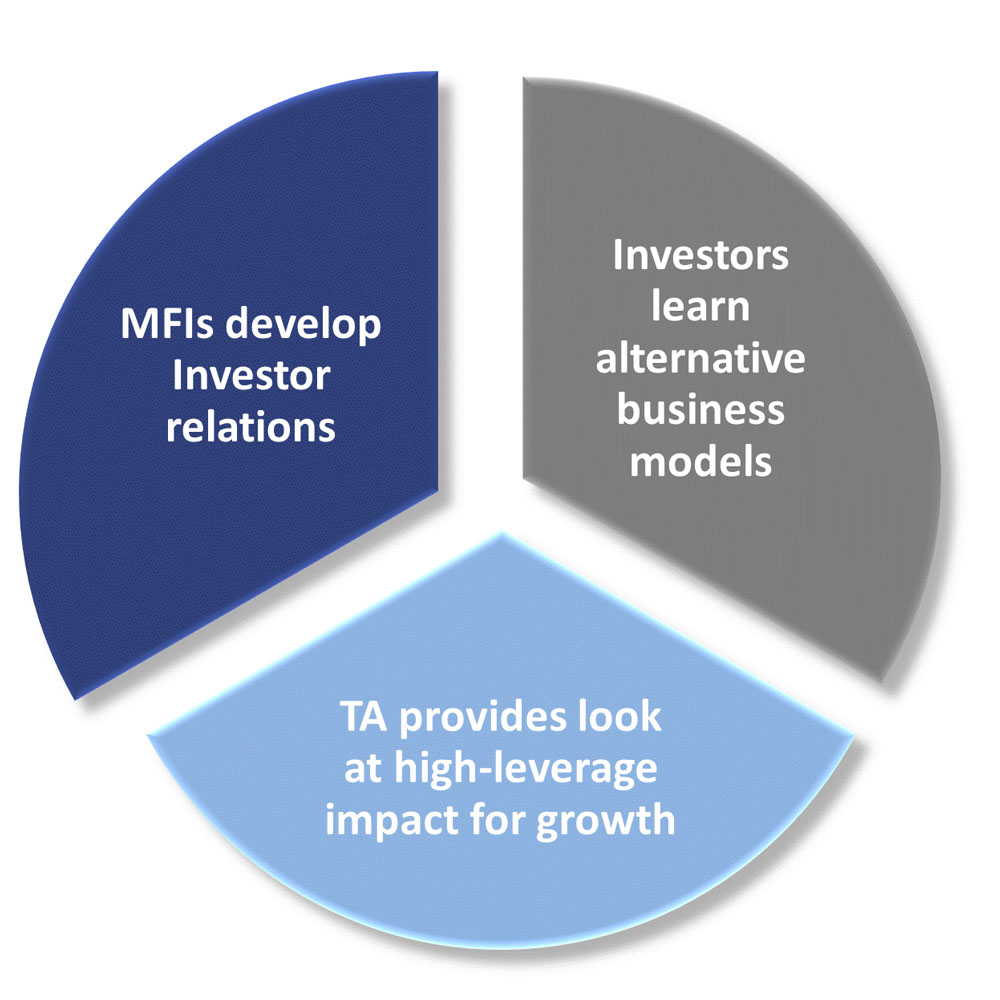

Michael Crayne is a financial inclusion professional. At FS Impact Finance he invests in financially sustainable and socially responsible microfinance institutions, while working on its future crowdfunding platform to fund green growth in Africa and Latin America.